Whatever You Required to Know Concerning Offshore Firm Formation

Navigating the intricacies of offshore company development can be an overwhelming task for several people and services seeking to increase their procedures worldwide. The allure of tax advantages, property protection, and boosted personal privacy frequently draws rate of interest towards establishing offshore entities. The elaborate internet of lawful needs, regulatory structures, and monetary factors to consider can position substantial challenges. Recognizing the subtleties of offshore firm development is vital for making informed decisions in a globalized business landscape. By untangling the layers of benefits, challenges, actions, tax ramifications, and conformity responsibilities connected with offshore company formation, one can obtain a detailed insight right into this diverse topic.

Advantages of Offshore Company Development

The advantages of developing an overseas company are complex and can substantially profit services and individuals looking for calculated economic planning. One essential advantage is the potential for tax optimization. Offshore business are usually subject to positive tax laws, permitting decreased tax obligation liabilities and boosted profits. Furthermore, setting up an offshore business can supply property security by separating personal possessions from service liabilities. This separation can protect individual wide range in case of legal disagreements or monetary difficulties within the organization.

In addition, overseas business can facilitate international service procedures by giving access to worldwide markets, expanding profits streams, and enhancing business reputation on a global range. By establishing an overseas existence, companies can tap right into brand-new opportunities for development and expansion beyond their residential boundaries.

Typical Challenges Faced

Despite the many advantages associated with overseas company development, individuals and organizations usually experience usual difficulties that can influence their operations and decision-making processes. Navigating differing legal structures, tax legislations, and reporting requirements throughout various jurisdictions can be complicated and time-consuming.

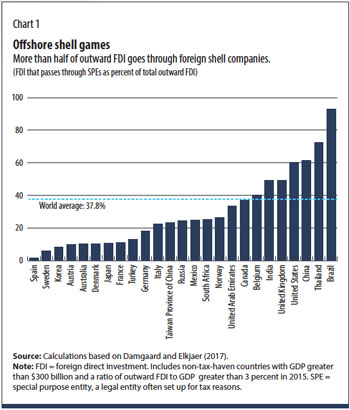

An additional typical difficulty is the danger of reputational damage. Offshore business are occasionally viewed with skepticism because of issues regarding tax obligation evasion, cash laundering, and lack of transparency. Managing and alleviating these understandings can be difficult, especially in an increasingly inspected global service setting.

Additionally, developing and preserving effective communication and oversight with overseas operations can be challenging as a result of geographical ranges, cultural distinctions, and time zone disparities. This can bring about misconceptions, delays in decision-making, and problems in keeping an eye on the efficiency of overseas entities. Overcoming these obstacles needs cautious preparation, persistent risk administration, and a comprehensive understanding of the regulatory landscape in overseas jurisdictions.

Actions to Type an Offshore Business

Establishing an offshore firm involves a series of calculated and legitimately certified actions find this to ensure a smooth and effective development process. The very first step is to pick the offshore jurisdiction that ideal matches your business requirements. It is crucial to comply with ongoing reporting and compliance requirements to preserve the good standing of the overseas company.

Tax Obligation Ramifications and Factors To Consider

Purposefully browsing tax obligation effects is vital when forming an offshore business. Among the primary factors individuals or services choose offshore company development is to take advantage of tax advantages. Nevertheless, it is important to conform and comprehend with both the tax legislations of the offshore jurisdiction and those of the home nation to ensure lawful tax optimization.

Offshore companies are frequently based on favorable tax regimes, such as low or zero corporate tax obligation rates, exemptions on specific kinds of earnings, or tax deferral alternatives. While these advantages can result in considerable savings, it is essential to structure the overseas company in a means that straightens with tax obligation laws to avoid prospective legal issues.

In addition, it is crucial to consider the effects of Controlled Foreign Company (CFC) guidelines, Transfer Rates guidelines, and other global tax regulations that may influence the tax obligation treatment of an overseas company. Looking for guidance from tax obligation professionals or professionals with experience in offshore taxes can assist browse these complexities and make certain compliance with appropriate tax guidelines.

Managing Compliance and Rules

Navigating with the detailed web of conformity needs and policies is important for ensuring the seamless procedure of an overseas company, especially in light of tax implications and considerations. Offshore jurisdictions commonly have check this specific legislations controling the formation and operation of firms to prevent money laundering, tax evasion, and various other illicit activities. It is essential for companies to remain abreast of these policies to stay clear of hefty fines, legal problems, or perhaps the possibility of being closed down.

To take care of conformity effectively, offshore companies must designate experienced specialists that recognize the neighborhood regulations and worldwide requirements. These experts can assist in developing appropriate administration structures, preserving exact financial records, and sending called for records to governing authorities. Normal audits and testimonials should be conducted to ensure recurring conformity with all pertinent regulations and laws.

In addition, remaining notified regarding changes in legislation and adapting techniques accordingly is vital for lasting success. Failing to adhere to policies can taint the credibility of the company and lead to extreme repercussions, highlighting the value of prioritizing compliance within the overseas business's operational structure.

Conclusion

In final thought, offshore business formation offers various benefits, but additionally comes with challenges such as tax implications and compliance needs - offshore company formation. By adhering to the essential actions and taking into consideration all facets of creating an overseas business, companies can take advantage of international chances while managing threats properly. It is necessary to stay informed concerning guidelines and stay compliant to guarantee the success and durability of the offshore organization endeavor

By untangling the layers of advantages, difficulties, steps, tax obligation ramifications, and conformity responsibilities linked with overseas company development, one can acquire a thorough insight into this multifaceted subject.

Offshore firms look at this site are commonly subject to favorable tax obligation regulations, allowing for minimized tax obligations and increased revenues. One of the key factors individuals or organizations opt for overseas firm formation is to profit from tax benefits. Offshore jurisdictions commonly have details legislations controling the formation and procedure of companies to stop cash laundering, tax evasion, and other illegal tasks.In final thought, overseas firm development provides different advantages, yet also comes with difficulties such as tax obligation effects and conformity needs.